ブログ投稿

Retail holiday outlook: Apparel and Consumer Packaged Goods

It’s no surprise that October–December is usually a sweet spot for retail, and holiday 2021 is no exception. According to a recent NPD publication, 29% of consumers plan to spend more on holiday shopping than they did last year.1 While this trend should take place across all types of businesses, Microsoft Advertising Insights took a deeper dive to forecast expectations on retail spending for two major sub-categories: Apparel and Consumer Packaged Goods (CPG). While individual search trends and queries may look different based on which Q4 holiday we’re talking about, expect to see large growth across the board for these two categories in upcoming months across the globe.

Apparel: More shopping and gifting moments

Microsoft Advertising Insights analyzed the current retail spend and trends across multiple countries, including the United States (US), United Kingdom (UK), France, Italy, Spain, and the Netherlands. While sales by clothing category differed between countries, one trend remained consistent: expect Q4 apparel growth to happen shortly (that is, if you aren’t already seeing escalated spend for your brand). A look into the key takeaways for two key markets are as follows:

- US: Holiday shopping is starting early this year, with almost 70% of consumers expected to start earlier than October 2021.2 Apparel is trending upward across several categories that actually decreased year over year (YoY) in 2020 due to COVID shutdowns. For example, formal wear and dress shoes both saw steady declines in 2020 but are expected to spike in 2021 as people return to the workforce and go out more often (formal wear projected growth: +120% YoY; dress shoes projected growth: +85% YoY).3 Additional categories that are expected to grow this season after year over year declines in 2020 include: bags and luggage and party supplies, due to a prevalence of family gatherings and travel this holiday season.3

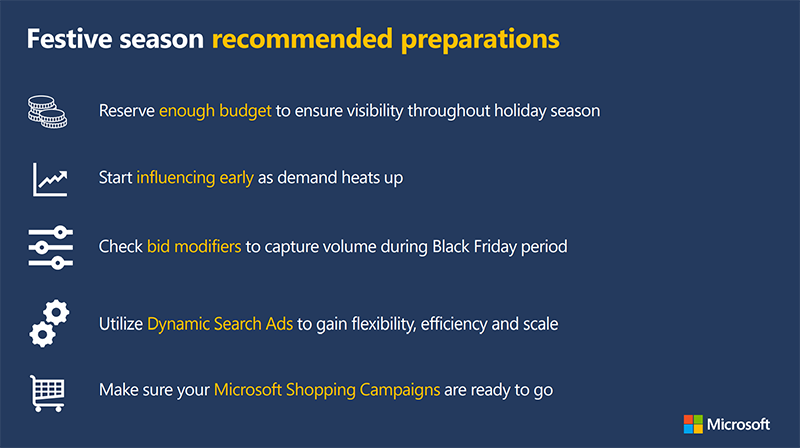

Pro Tip: Utilize Dynamic Search Ads to target new relevant queries and Responsive Search Ads to show the most relevant ad for holiday shoppers.

- UK: Consumer engagement for apparel is at an all-time high and double-digit growth is expected YoY this holiday season.4 Online apparel shopping is especially popular, even outpacing overall retail sales growth (+78% growth since 2019).5 Consumer behavior is also shifting with this change as shoppers spend more time browsing on their mobile devices, interacting with shopping ads at almost twice the rate they were before, thus becoming less brand loyal.5

Pro Tip: Use Product Ads to showcase products in impactful ways that include custom images, pricing or your company name – putting searchers closer to making a purchasing decision. We’ve seen UK Product Ads drive a +89% YoY growth in apparel clicks so far this year.6

Consumer Packaged Goods: More gathering moments

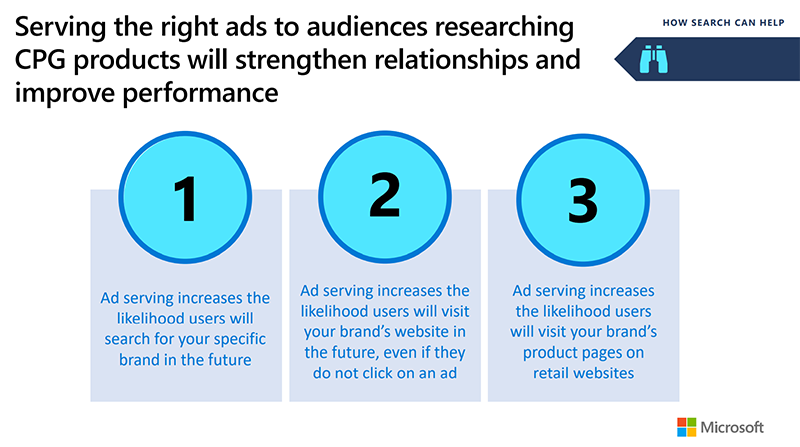

We expect growth in CPG this year across multiple days in Q4 (Halloween, Diwali, Hanukkah, Thanksgiving, Christmas, and New Year’s, among others). Dining and entertaining is a core part of these holidays and we found that consumers are more likely to host or attend small celebrations in 2021 than they were last year.7 Search engines are becoming incredibly important to CPG shopping. Not only did weekly average search volume grow 25.8% from 2020 to 2021, but when searchers were exposed to a CPG company’s brand during a non-brand search, they were 157% more likely to search for that brand in the future.7

Knowing that each of these seasonal holidays have popular dishes, it is important to expand your keyword coverage accordingly. To help, we have made a list of the most popular queries searched for in 2020 on our network, per seasonal event:

- Halloween 2020 popular queries8

- “halloween food ideas”

- “easy halloween food ideas for parties”

- “halloween recipe”

- Diwali 2020 popular queries8

- “diwali food”

- “diwali snacks”

- “diwali food menu”

- Hanukkah 2020 popular queries8

- “hanukkah recipes”

- “hanukkah recipes”

- “hanukkah recipes easy”

- Thanksgiving 2020 popular queries8

- “thanksgiving menu planning”

- “thanksgiving meal ideas”

- “traditional thanksgiving pie recipes”

- Christmas 2020 popular queries8

- “prime rib christmas dinner”

- “traditional christmas meal”

- “side dishes christmas dinner”

- New Year’s 2020 popular queries8

- “traditional new years food”

- “eat new years”

- “food new years”

Pro Tip: Reach consumers near you who are unfamiliar with your brand. Non-brand keyword campaigns reach shoppers before they’ve decided on a brand and help grow acquisition and sales (see examples of non-brand queries above). Location Extensions make it easy for customers to see your address, phone number, directions, URL and business description while increasing click-through rates 7-10%.7

Dive deeper with case studies

Now that you’ve seen our insights for both Apparel and CPG advertising trends, you may be wondering who has this really worked for. We’ll outline two client success stories, one for Apparel and one for CPG, so you can take learnings from those who have implemented our recommendations to achieve their goals and key performance indicators (KPIs).

- Merkle case study: For the 2019 holiday season, the leading US fashion brand Merkle was looking to get incremental volume, while still maintaining their return on ad spend (ROAS) and cost per acquisition (CPA) goals. Microsoft Advertising worked closely with the brand on choosing the best products for their KPIs, including Microsoft Audience Ads and Dynamic Remarketing. The results were telling with the client achieving a 182% higher ROAS while decreasing their CPA by 75%. After such tremendous success, they are now adjusting and scaling their budgets with us.9

- Santa Barbara Chocolate case study: The company wanted a new campaign strategy, so they partnered with both Sales & Orders and Microsoft Advertising to try something different. Sales & Orders integration with Microsoft Ads Application Programming Interface (API) allowed Sales & Orders to optimize the chocolate supplier’s product titles by including actual search terms used by shoppers and applying hyper-focused location targeting. From here, product-level ad groups were created for both shopping and search campaigns using product ads on Microsoft Merchant Center. Santa Barbara Chocolate achieved a 476% increase in conversion rate, a 5x increase in ROAS,10 and raised its average revenue growth by 315% in less than a year.

[8] Microsoft internal data.