Blog post

Key differences between younger and older travel audiences

As global restrictions finally began to lessen, 2022 was the year travel came back. Countries around the world have started to welcome tourists back, and people have been eager to get out of their house. 2023 is off to a great start as well, with predictions that we’ll continue to see consumers exploring different travel options, both domestic and international.1

Of course there’s always going to be differences in the way people of different demographics travel. To explore this idea, Microsoft Advertising Insights analyzed the variations between older and younger demographics (seniors vs. millennials/gen z). We compared statistics by age for topics like travel search growth rates, average ad exposure and time spent on ads, and consumer decision journey insights.

Younger audiences want to travel more

For starters, we found that young travelers (under 50) are forecasted to grow at a much faster rate than the older market. Looking at travel search rates since 2018, we found that young travelers are predicted to grow 100% faster than the 50+ travel market.1 Younger travelers also have a stronger interest in travel destinations at large.

When looking into search interest share by age group, we found that people aged 18-24 led in seven out of the eight top global markets for international travel (the United States, the United Kingdom, Spain, the Netherlands, France, Canada, and Australia). For the eighth market (Germany), consumers aged 25-49 led in search share. And for all eight markets, older generations (50+) had the least number of international searches.1

Meet consumers early in their journey

Despite leading in search share, we found that the younger travelers have a shorter decision journey length than older travelers. 61% of seniors shopped for 2-3 months prior to purchasing travel, compared to 58% of millennials and gen z consumers who only shopped for less than one month.1 Part of the reason seniors take longer to convert could be their increase in wanting to use travel agents to help them make decisions since the onset of COVID-19 (+25% more likely than pre-COVID).2

Seniors are, on average, exposed to more ads during their decision journey than other ad groups, but all age groups still tend to have multiple touchpoints prior to making their decision. In fact, at least 93% of all consumers aged 18-65+ had multiple touchpoints in their journey as opposed to a single touchpoint journey.1

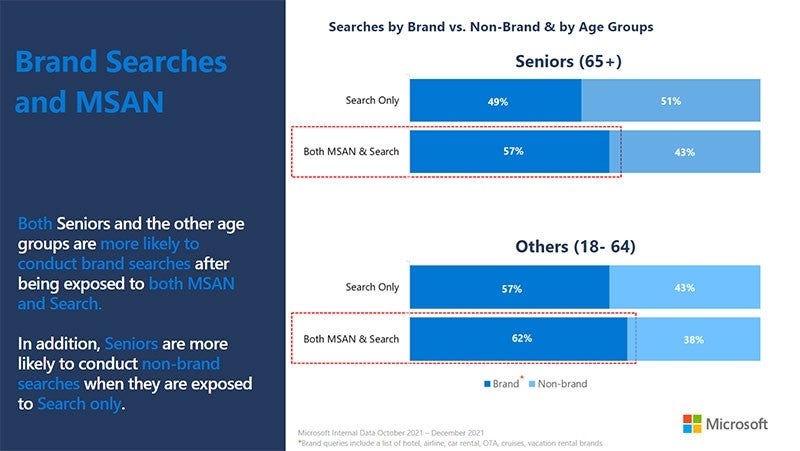

Travel advertisers who have had the best luck on our Microsoft Audience Network also commonly use a combination of both Search and Audience Ads for their campaigns. Regardless of age, consumers are more likely to conduct brand searches on our network after being exposed to both Audience and Search Ads.1 This shows the value of the Microsoft Audience Network, which can help you extend your reach and campaign performance by meeting consumers earlier in their journeys.

Learn more

For more information on how consumer behavior for these travel audiences varies, or to see a full length version of the analysis deck, reach out to the Advertising Analytics Insights Group here at Microsoft Advertising.

[1] Microsoft.com Insights, Microsoft Advertising Insights search data 2018-2022.

[2] Travelport, Guide to Travel Recovery. Retrieved from: https://www.travelport.com/guides/recovery-guide